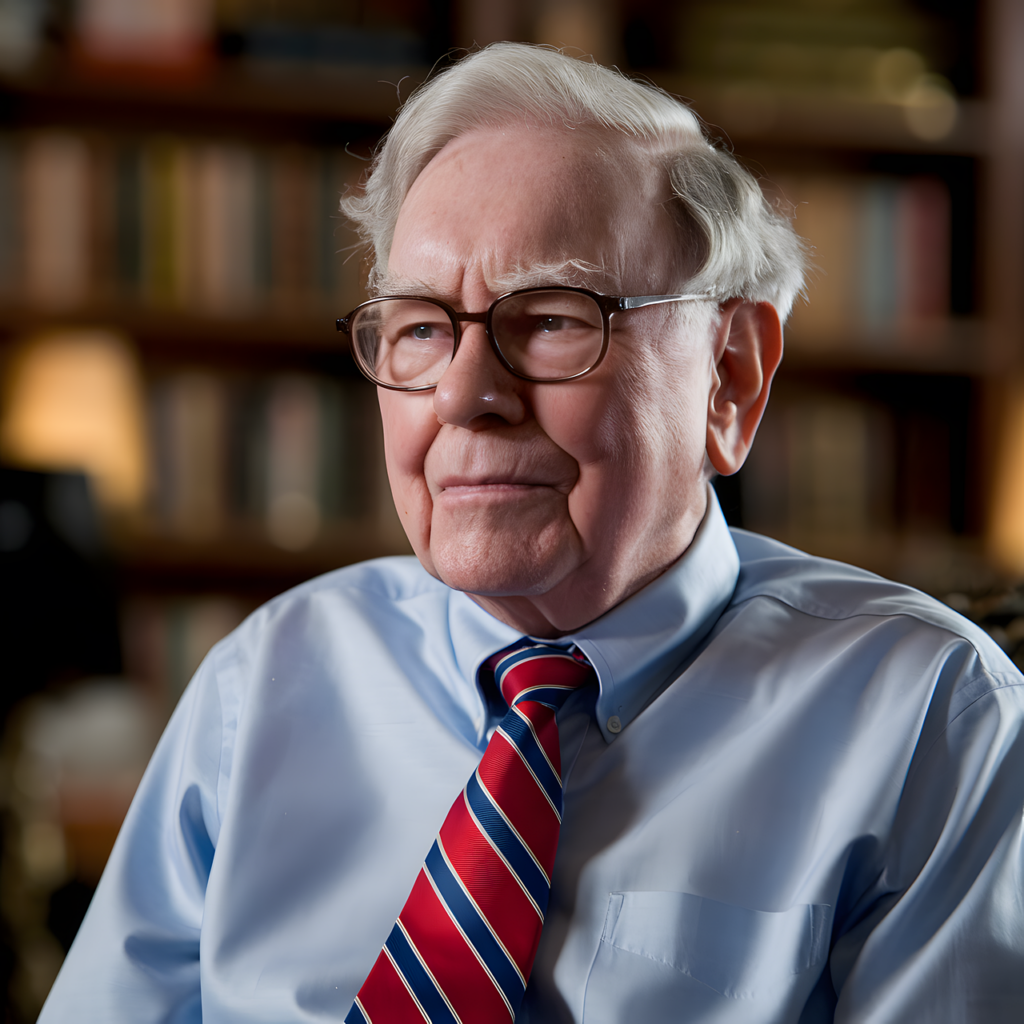

Here are all 44 stocks Warren Buffett owns

– Form 13Fs allow investors to see which stocks Wall Street’s smartest money managers – including Warren Buffett – are buying and selling. – The Oracle of Omaha oversees a portfolio of 44 stocks totaling $291.2 billion at Berkshire Hathaway. – Buffett is a big fan of portfolio concentration, with nearly 75% of Berkshire’s invested assets tied up in just seven top stocks. Despite Buffett overseeing stakes in nearly fifty securities, the lion’s share of Berkshire’s invested assets have been put to work in seven top ideas. There aren’t too many managers on Wall Street who get the attention of professional and everyday investors quite like Warren Buffett. Since becoming CEO of Berkshire Hathaway in the mid-1960s, the aptly named “Oracle of Omaha” has overseen a striking return of more than 5,470,000% in his company’s Class A shares. When you smoothly outperform the S&P 500, you will become famous. In addition to running circles around Wall Street’s benchmark index for nearly six decades, Buffett is prized for his open-book strategy. Whether it’s in his annual letter to shareholders or during the firm’s annual shareholder meeting, Buffett regularly discusses the characteristics he looks for in investments and shares his thoughts on the US economy and stock market. But perhaps the most valuable information shareholders receive is Berkshire’s quarterly Form 13F, which is a filing detailing the company’s stock holdings, as well as what stocks Buffett is buying and selling. Excluding the two index funds Berkshire has a relatively small position in — index funds consist of baskets of securities and are therefore not stocks — Warren Buffett oversees a 44-stock, $291.2 billion investment portfolio at Berkshire Hathaway. What follows is a detailed breakdown of each stock you’ll find in the Oracle of Omaha’s portfolio.

Warren Buffett’s portfolio at Berkshire is highly concentrated on his best ideas

Probably the most defining characteristic of Buffett’s investment strategy is that he favors portfolio concentration. In other words, he prefers to have an outsized share of Berkshire’s capital invested in his best ideas. Currently, almost 75% of Berkshire’s invested assets are tied to just seven stocks (all market capitalization data as of the close of trading on December 19, 2024). 1. Apple: $74,937,000,000 2. American Express: $44,434,063,956 3. Bank of America: $33,242,330,942 4. Coca-Cola: $24,980,000,000 5. Chevron: $16,741,876,874 6. Occidental Petroleum: $11,579,569,929 7. Moody’s: $11,399,657,716 One of the bigger stories of 2024 among these top stocks has been Buffett’s penchant for hitting the sell button. Berkshire Hathaway has been a net seller of shares in each of the last eight quarters, with this selling activity really ramping up in 2024 – more than $127bn of net share sales in the first nine months of the year. While Apple has accounted for the largest amount of sales in nominal dollar terms, the recent reduction in Berkshire’s stake in Bank of America is perhaps more eye-opening. Buffett has parted with over 266 million shares since mid-July. Given that financials are Buffett’s favorite sector to invest in, selling 26% of Berkshire’s stake in BofA is worrying. Aside from locking in profits at a favorably low tax rate, Buffett and his team may be concerned about lower interest rates negatively impacting Bank of America’s net interest income. Likewise, the stock market is historically expensive, which could entice Berkshire’s manager to build a huge cash position. You’ll also note that energy stocks play a key role in Berkshire’s portfolio, with Chevron and Occidental approaching a 10% combined share of invested assets. Both companies are integrated energy operators, but primarily benefit from their drilling operations. If the price of crude oil rises, Chevron and Occidental will be sitting pretty. The Oracle of Omaha oversees 20 other billion-dollar bets on Berkshire Hathaway

Although Buffett’s largest bets make up the lion’s share of invested assets, there are another 20 holdings that range in value from $1 billion to as much as $9.8 billion. Some of these positions are “indeterminate” holdings for the Oracle of Omaha, as well as companies that have really caught his attention.

8. Kraft Heinz: $9 801 608 022 9. Chubb: $7 384 548 437 10. Mitsubishi: $5 689 146 301 11. Itochu: $5 633 643 875 12. DaVita: $5 325 540 398 13. Mitsui: $5 042 679 316 14. Citigroup: $3 779 849 011 15. Kroger: $3 048 000 000 16. Visa: $2 612 704 205 17. VeriSign: $2 479 052 179 18. Sirius XM Holdings: $2 315 347 323 19. Amazon: $2 232 900 000 20. Sumitomo (SSUM.Y 1,89 %) (SSUM.F 4.21%): USD 2 102 156 728 21. Mastercard: USD 2 086 133 165 22. Marubeni (MARUY 2.42%): USD 1 997 747 403 23. BYD: USD 1 847 682 841 24. Capital One Financial: USD 1 598 506 000 25. Aon: USD $1 450 375 000 26. T-Mobile: $1 018 496 000 27. Ally Financial: $1 004 270 000 The standouts of this group are the five Japanese trading houses that Buffett sees as perpetual holdings: Mitsubishi, Itochu, Mitsui, Sumitomo and Marubeni. The only reason these five stocks are not major holdings is that Berkshire is limited to a maximum 9.9% stake in each of the five. The beauty of these five companies is that they have their proverbial fingers in virtually every aspect of Japan’s economy. They are involved in oil and gas, food production, mining, textiles, pharmaceuticals, chemicals and so on. If you believe the Japanese economy will grow over time, these five stocks offer an easy way to capitalize on that growth. What’s more, Mitsubishi, Itochu, Mitsui, Sumitomo and Marubeni are all relatively cheap, compared to one of the most expensive US stock markets in history. In addition, they are known for their low executive compensation packages and hefty capital return programs. Property and casualty insurer Chubb is another stock that clearly has Buffett’s undivided attention. Chubb was the stock that received “confidential treatment” between July 2023 and mid-May 2024 that Buffett secretly built up a significant stake in. Although the insurance business is rather boring, it is very profitable. Chubb typically has strong premium pricing power and is currently taking advantage of higher Treasury yields to generate more interest income on its float (i.e. excess premium collected that has not been paid out via claim).

A look at Buffett’s smaller positions (under $1 billion)

The remaining holdings in Berkshire Hathaway’s $291 billion portfolio range from $8 million to $995 million. 28. Charter Communications: $995,474,255 29. Nu Holdings: $892,914,839 30. Liberty Live Series C: $736,396,234 31. Liberty Formula One Series C: $730,929,987 32. Louisiana-Pacific: $615,208,750 33. Domino’s Pizza: $546,205,756 34. Liberty Live Series A : $331,657,968 35. Heico Class A: $193,992,654 36. Pool: $137,759,194 37. NVR: 90 020 646 USD 38. Jefferies Financial Group: $32,629,575 39. Diageo: $28,978,910 40. Lennar Class B: $20 417 185 41. Liberty Latin America Series A: $16,468,758 42. Ulta Beauty: $10,298,861 43. Atlanta Braves Holding Series C: $8,536,530 44. Liberty Latin America Series C: $7,986,604 You’ll note that this section features Buffett’s favorite stock from the third quarter, fast food restaurant chain Domino’s Pizza. Domino’s has been virtually unstoppable for 15 years thanks to ongoing product and process innovation, along with its ability to earn and keep the trust of consumers. The company’s latest five-year plan, called “Hungry for MORE”, is focused on improving product consistency, increasing production and streamlining the supply chain, among other things. It is also worth pointing out that Domino’s Pizza is on track to deliver its 31st consecutive year of same-store sales growth in international markets. The company’s brand and product innovation are clearly on point – and few investors understand consumer buying habits better than the Oracle of Omaha. Another thing to note about these smaller holdings is that this is where you’ll see the influence of Buffett’s investing lieutenants, Todd Combs and Ted Weschler, come into play. Combs and Weschler tend to be more active than Buffett on the trading front, and they typically manage positions that range in size from $10 million to $1 billion. Chances are that Berkshire’s holdings in homebuilders and Ulta Beauty are one or both of Buffett’s top advisors.

Viking offers price data on US stocks

Want to follow and analyze some of the biggest companies in the world? Here you can analyze the giants like Berkshire, Apple, Microsoft, JP Morgan and Google. You can do this by adding the extensions Nasdaq and NYSE, the New York Stock Exchange, from as little as $58 per month.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)