How Kodak went from being the world’s most powerful photo company

In 1975, Kodak was the world’s most powerful photo company, worth $31 billion. By 2012, they were completely bankrupt. Not because of competition or technology – but because of a fateful decision. Here’s the biggest business mistake in history (and how to avoid it): It’s 1975 and Kodak owns the photo industry: – 90% of film sales worldwide – 85% of camera sales – $10 billion in annual revenue – Millions in pure profit every day

One engineer was about to change everything…

A young engineer named Steve Sasson walks into Kodak’s lab: “I’ve invented a camera that doesn’t need film” The room falls silent. The prototype works perfectly. Kodak’s response? It would shock everyone… The executives were clear: “Bury it” “Patent it” “Don’t tell anyone” Their reasoning? Kodak was making 15 dollars per roll of film. Why kill a cash cow? The digital camera could destroy their empire: – 2.5 billion rolls of film sold annually – 60% profit margins – Billions in processing equipment

They had too much to lose. Or maybe they thought…

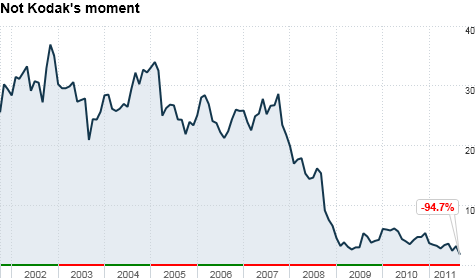

1995 changed everything: Digital cameras flood the market. Their competitors race to adapt Kodak’s answer? Double down on film and disposable cameras. Kodak’s single-use camera strategy seemed to be working: in 1996, Kodak was still the fourth most valuable company Single-use cameras were booming Billions in film sales Reality was about to hit hard. By 2005, the numbers were brutal: Digital camera sales were exploding. Kodak’s share price plummeted by 75 percent. Yet the company’s management stuck with film to the end.

January 2012: Kodak entered Chapter 11, a form of bankruptcy that led to 28,000 employees losing their jobs and 142 years of history coming to an end. All because greed made Kodak bury tomorrow. The biggest irony? Kodak invented the digital future then management killed it to protect the past. Today, their 1975 patents are worth more than the entire company.

The lesson? Sometimes your biggest threat is not your competitors. It’s your own success. Blinding you from innovation.

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)