A surge in savings in India bodes well for the country’s future

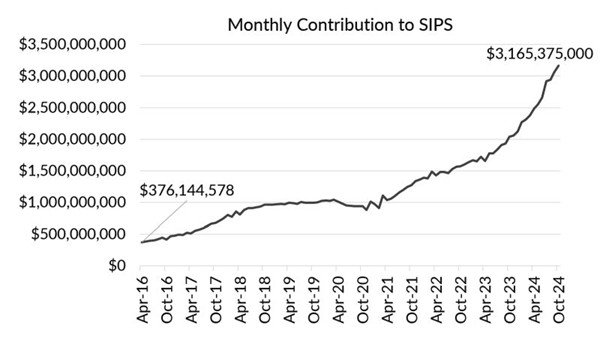

Every month, local Indian investors invest over three billion dollars in their home market through so-called SIP schemes, also known as systematic investment plans. These can be partly compared to investment savings accounts in Sweden. The surge in savings in India is almost nine times higher than what these investors put into the stock market eight years ago. The more than three billion dollars that these investors are putting in every month is equivalent to an annual amount of 38 billion dollars. How much will that figure grow over the next eight years? I imagine it will be significant. India’s moment is happening now. Huge long-term tailwind.

Source: Association of Mutual Funds in India, Morgan Stanley

Source: Association of Mutual Funds in India, Morgan Stanley

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)