Not normal behavior for Nasdaq

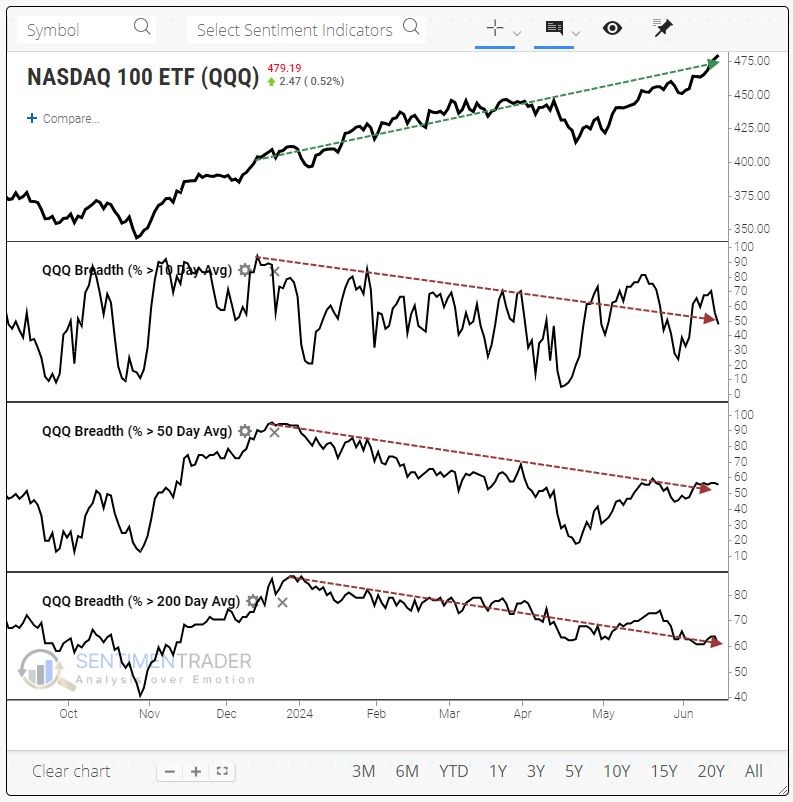

As highlighted by Sentiment Trader, the market breadth of the Nasdaq 100 is indeed a growing concern. What we are seeing right now is not normal behavior for Nasdaq. The Nasdaq 100 continues to trade at record high after record high.

Many of the stocks included in the index not only lag, but they fall to monthly, quarterly or even annual lows and below their 10-, 50- and 200-day moving averages.

This is not normal behavior for the Nasdaq 100. In fact, it has never happened before to this degree.

There is a possibility that the average stock will catch up with the index, but this is not usually the case. Almost never, in fact. The risk is high in that index.

About the Vikingen

About the Vikingen

With Vikingen’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Vikingen’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on. Vikingen is one of Sweden’s oldest equity research programs.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to get even richer (vikingen.se)