Description:

For those who want to study ATR. And have Viking Trading or Viking Option can create their own model as shown below.

The code is:

par(main: instrument;

AntPer: integer;

out ATR:realvector);

was

FilledClose, FilledHigh, FilledLow : RealVector;

R1, R2, R3, R4, TR: realvector;

beginning

FilledClose := std.FILL(Main.Close);

FilledHigh := std.FILL(Main.High);

FilledLow := std.FILL(Main.Low);

// the difference between the current Highest and Lowest

R1 := FilledHigh-FilledLow;

// the difference between today’s Low and yesterday’s Close

R2 := std.Abs(FilledLow-Shift(FilledClose,1));

// the difference between today’s Supreme and yesterday’s Close

R3 := std.Abs(FilledHigh-Shift(FilledClose,1));

// largest difference is saved in TR (True Range)

R4 := std.Alt((R1 > R2), R1, R2);

// largest difference is saved in TR (True Range)

TR := std.Alt((R3 > R4), R3, R4);

// exponential MV is calculated AntPer= number of periods

ATR := std.Mavx(TR, AntPer);

end;

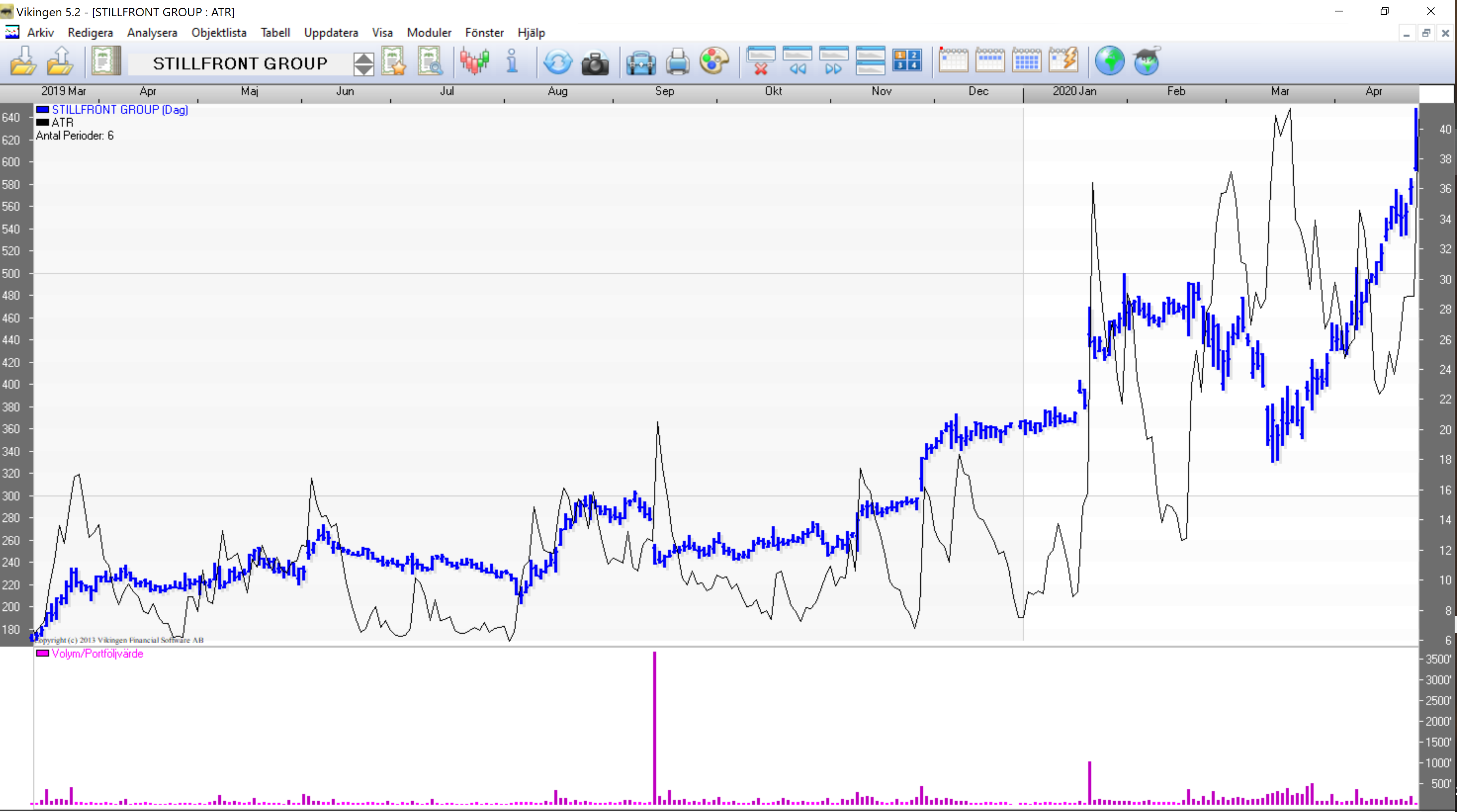

The presentation could look like this if the price bar is placed on the left and the ATR on the right.