Strongest PPM funds right now

Strongest PPM funds right now

The strongest PPM funds right now are doing very well. The best performing funds are Japan, India, America and short-term funds. Since the Nordic stock markets have been doing poorly, it is easy to think that all the world’s stock markets are doing poorly. This is not the case. Join the boom in Japan, India and the US. Or if you’re feeling anxious, you can invest your money in a short-term interest rate fund instead.

The list of the strongest PPM funds

| Object | Latest |

| SKANDIA JAPAN | 304,69 |

| STOREBRAND JAPAN A SEC | 129,36 |

| CARNEGIE LISTED PRIV EQUITY A | 592,92 |

| PICTET – JAPANESE EQ OPP R JPY | 14960,27 |

| NORDEA INDIAN FUND | 438,39 |

| LÄNSFÖRS JAPANFOND INDEXNÄRA | 168,36 |

| CARNEGIE INDIAN FUND A | 848,1 |

| EAST CAPITAL FRONTIER MAR. SEK | 196,37 |

| LÄNSFÖRSÄKRINGAR USA ACTIVE | 829,25 |

| LÄNSFÖRSÄKRINGAR USA INDEX CLOSE | 788,77 |

| SPILTAN GLOBALFOND INVESTMENT | 248,89 |

| ÖHMAN ETHICAL INDEX USA | 465,16 |

| ROBUR ACCESS USA A | 589,38 |

| HANDELSBANKEN AMERICA THEME | 2018,44 |

| SKANDIA NORTH AMERICA EXPOSURE | 521,31 |

These funds were developed using an autopilot that lists the funds with the largest upward slope over the last 20 weeks, i.e. autopilot 18, regression week. Some funds were weeded out with old data and which have a falling trend in recent days. Around 500 funds in total. I also removed the funds that I have myself. They are also at the top, but the above 15 funds will have to suffice.

Read more about PPM funds: https://www.pensionsmyndigheten.se/

Best short-term funds

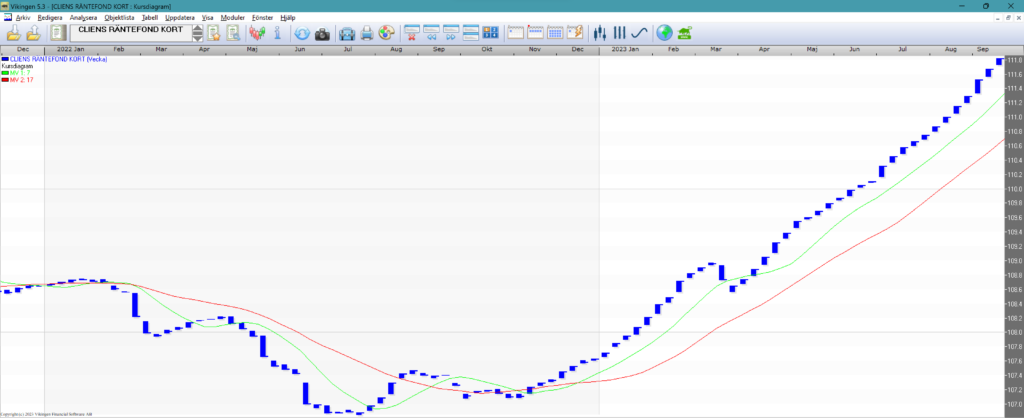

There are so many right now, it’s hard to list them all. In general, short-term funds are doing well now (less than one year). Here is an example of what a short-term interest rate fund looks like. It’s hard to say it’s a curve, it’s mostly a straight line with a strong upward slope.

About the Viking

Funds can be added to all Viking packages. PPM funds are already included in all packages, even in the Viking Mini. In total there are around 17000 funds, mostly equity funds.

The Viking Mini costs €75 per month or €750 per year. If you add equity funds, fixed income funds, mixed funds or hedge funds, they cost the same per fund type. There are about 14500 equity funds. Use the Viking to select the best ones and sell them on time! Read more about funds here