Dollar recovery threatens to be entrenched

For those seeking more than just analysis of the dollar index DXY which is a benchmark for currencies as a whole, this article looks at eight major spot Forex pairs that make up the lion’s share of the huge global currency market while ensuring the critical diversity key to successful investing. Will there be a dollar recovery?

The backlash from a 1.128 Fib retracement has been cushioned by the previous flag below 1.10 but the EU will need to react up above the middle band (1.108) to propose a more substantial capture. Pressing through 1.095, meanwhile, would only intensify the appearance of a previous false breakout above 1.11 and warn of further steps down to the next resistance at 1.05.

Source: Vikingen.se

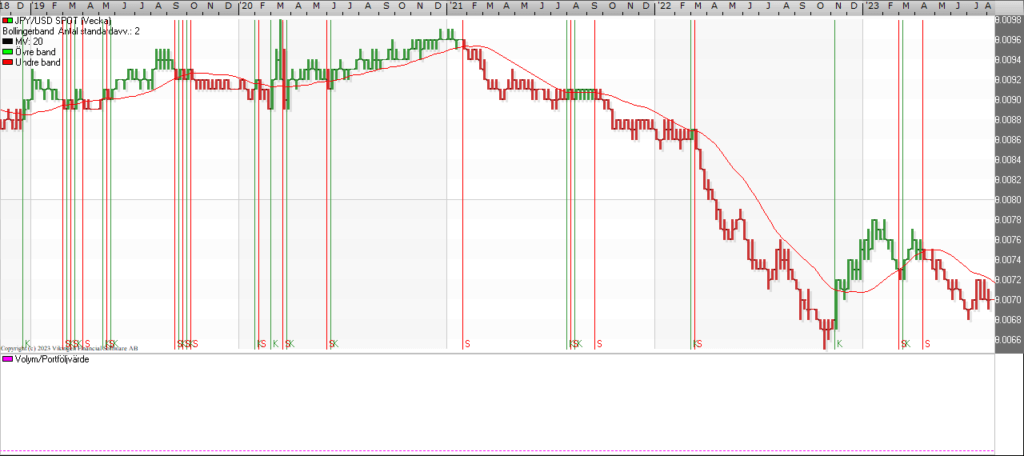

Japanese yen/US dollar

The main 138 resistance had to pass two tests but has propped up the US and spurred a break at 142 to propose a modest new double bottom. This involves tools to pry up the 145 tip and so open the passage to 152. Just slipping back below the middle band (140.6) would show vulnerability still where 138 may still be at risk.

Source: Vikingen.se

Source: Vikingen.se

Pound sterling/US dollar

The previous flag attempted to stem the pound’s retreat but has been picked apart to allow access to the incoming uptrend (1,273). This is likely the last chance to take back the setback and try for the 1.30s again. If the trend gave way, watch out for further erosion to 1.245 and potentially a sharper drop to 1.18 if the 1.24 brace failed to survive.

Source: Vikingen.se

Source: Vikingen.se

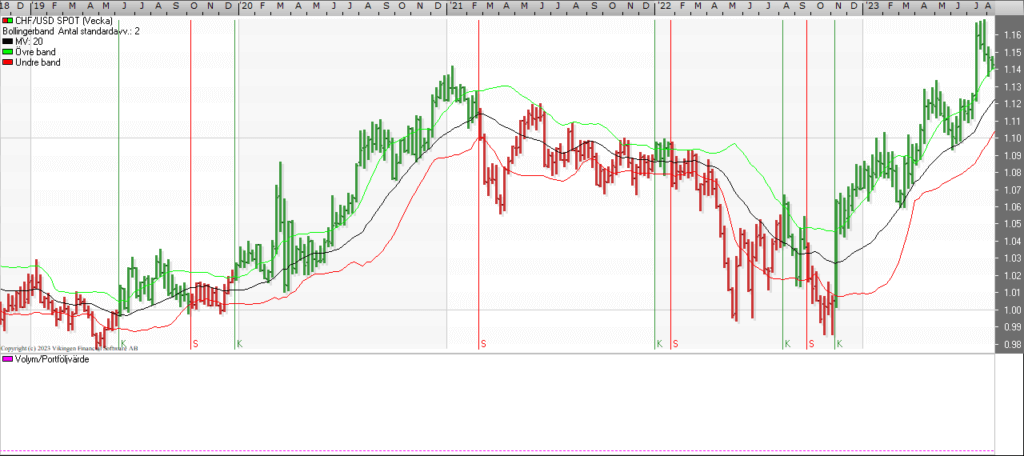

Swiss franc/US dollar

There was little support at first, but after achieving a target of 0.859 from the big double top of ’22, the US took hold and has jogged back above 0.87 to create a small new double bottom. This provides a shot above 0.882 but must defeat the downward trend (0.893) to make a lasting impression or beware of renewed scrutiny of the void below 0.87.

Source: Vikingen.se

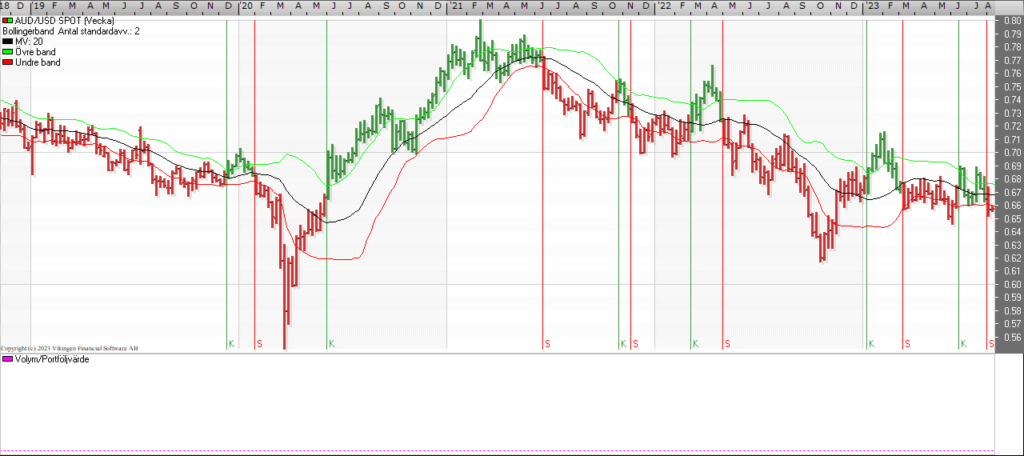

Australian dollar/US dollar

Last Q1 H&S kept the lid on and two recent peaks at 0.69 threaten to become a new double top as the 0.66 area tapers off. If confirmed, this double top looks like it could overpower the 0.646 valley and push to a 0.63 target. Only a quick recovery above 0.66 that soon pierced the middle band (0.673) would pick AD out of this problem.

Source: Vikingen.se

Source: Vikingen.se

Brazilian real/US dollar

The US has staged a first recovery from new mid-term lows but needs to broadcast the mid-band (4.796) and interim downtrend (4.85) to make a more convincing impression back to the upside and highlight a path towards 5.10. If otherwise held in check by the trend, be prepared for a next down wave continuing into the 4.50s.

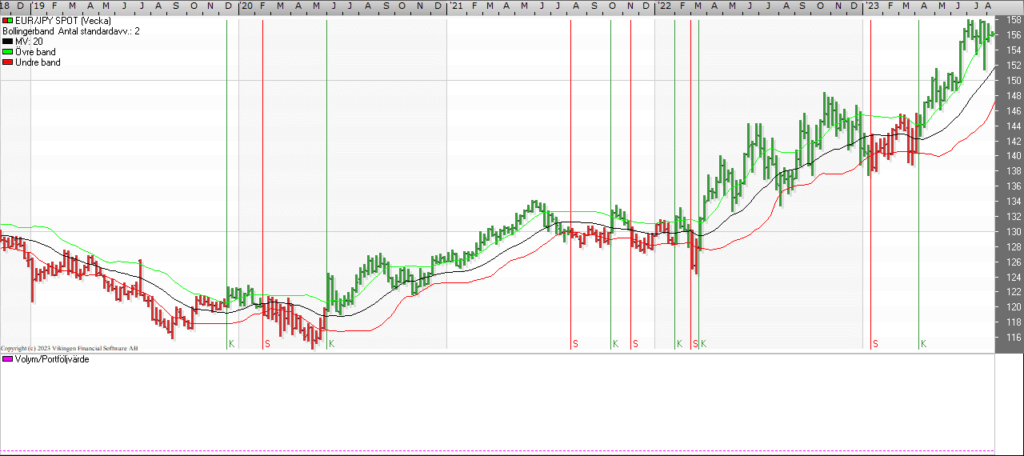

Euro/Japanese yen

Despite a temporary upward trend break, previous support at 151 soon rallied the EU and it is approaching a third attempt of the 158 area. The third test is usually ‘make or break’. Whiplash from 151 promises at first so shooting 158 would transform the sight to 170. Not much time to spare though and swinging back below 155 would revive the threat to 151.

Source: Vikingen.se

Source: Vikingen.se

Euro/British pound

While a mid-Jly peak was comfortably cushioned by the earlier H&S peak, the EU has since tamed the new decline for a period of nearby consolidation. Be careful of the bear flag on this break, so beware that breaking 0.855 can still make a dive from 0.85 to around 0.83. Need to get a foot back on 0.86 to reduce the risk with bear flag.

Source: Vikingen.se

Source: Vikingen.se

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)