A weak dollar creates opportunities in commodities

Since the beginning of July, the DXY, the US dollar index, has weakened by almost two percent. This decline created an opportunity in commodities and has primarily come in the 16 days since the US Bureau of Labor Statistics published the country’s latest annual inflation figure, which came in at three percent for June.

With inflation now approaching target levels, markets expect the Federal Reserve to end its rate hiking cycle in the near future, with the possibility of a final 25 basis point increase in September. As the USD has weakened in recent weeks, ChAI models have interpreted the relative appreciation of several currencies as important drivers of commodity prices. In this week’s blog, we will look at three examples of commodities and a correlated currency that have changed in value recently, and examine how the decline in USD strength is creating opportunities elsewhere.

Commodities and currencies

Before diving into the examples, it is worth explaining why the weakened US dollar is so important in commodity markets. With many commodities priced in dollars, its decline can lead to an increase in demand for commodities from countries that export them, as foreign buyers can purchase more goods with the same amount of their own currency. Moreover, when a country’s currency strengthens against the US dollar, it means that exporters from that country receive more of their own currency for each unit of the good sold in dollars. As a result, a weaker dollar can often lead to upward price pressures in commodity markets while increasing the strength of currencies that are closely linked to commodity prices.

There are other possible effects, such as reduced competitiveness of US exporters on the international market and increased inflationary pressures in the US. Finally, the weakened dollar must also be put in the context of broader economic trends and events, so the theoretical implications of the relative weakness of the dollar on commodity prices will not always translate into reality.

Copper and Peruvian sun

Peru is the second largest exporter of copper ore in the world, only after its southern neighbor Chile, and therefore the value of the Peruvian Sun is tied to the fortunes of the red metal. Indeed, copper ore accounts for over 25% of the value of Peru’s total exports.

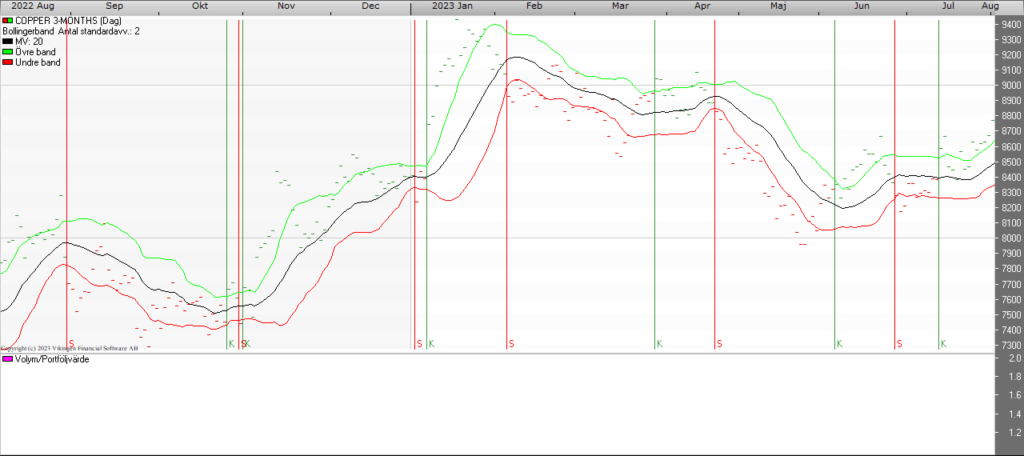

As early as November 2022, the US non-farm payroll report signaled that the Federal Reserve’s interest rate hiking program had begun to affect employment and wage inflation statistics, prompting market speculation that the pace of interest rate increases may be slowing down. Highlighted by the orange circle, the dollar weakened on this news, with the sun strengthening in comparison as copper prices rose.

Over the past six weeks, the sun has gradually strengthened against the dollar while copper prices have slid higher, climbing from $8,000/tonne at the end of May to close to $8,600/tonne currently. The green circle highlights the market reaction in early July to comments by Fed officials that the rate hike cycle is almost complete, after which there was a clear movement in both copper prices and dollar strength. Currently, ChAI’s models see the strengthening sun as a bearish driver for copper in the medium term. However, it is important to note that copper markets in 2023 are more likely to be driven by demand, or continued lack thereof, for the metal from China.

Source: Vikingen.se

Natural gas and the Norwegian krone

Since Russia’s invasion of Ukraine and the ensuing restrictions on Moscow, Norway has been elevated to become Europe’s primary source of oil and gas. As the continent sought to replenish its gas reserves for the winter of 2022/2023 without the usual Russian imports, Norway took a central role. As a result of the increased importance of European natural gas prices for the Norwegian economy, the downward drift of natural gas prices this year has weakened the krone. Since mid-December, marked by the orange circle in the graph below, TTF prices have steadily declined over the following seven months. Conversely, the krona follows a depreciation path until the end of May, highlighted in green, where its weakness against the dollar peaked.

Over the past two months, the krone has regained some strength against the dollar and, crucially for Norway, against the euro. Consequently, the ChAI models currently see the recent appreciation of the krona as bearish for TTF prices in the next quarter. However, as large parts of Europe are currently experiencing severe heat waves and droughts, leading to higher demand for air conditioning, it is possible that the demand for gas will drive up TTF prices while strengthening the krona.

Soybeans and the Brazilian real

Brazil is rich in resources, but one commodity market where it is becoming increasingly dominant is soybeans. Brazil has overtaken the US to become the leading exporter of soybeans globally, and is projected to produce a record crop of 155 million tons this year, more than 30 million tons more than the US. This swelling role in the global market has led to soybean prices becoming increasingly tied to the value of the Brazilian real. As the orange circle in the graph below shows, when grain and oilseed prices rose in early 2022 following Russia’s invasion of Ukraine, the dollar to real index moved in an almost exact inverse correlation to the price of CME soybean mines.

More recently, a similar pattern of rising soybean prices and a strengthening real has re-emerged. The ChAI models currently interpret the real as a bearish driver in the long run, but it is likely that the real will continue to increase as soybean prices rise before the two lines converge again. The extent to which China’s demand for soybeans this year lowers the record-high supplies will be key in determining when soybean prices fall again.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, and so on.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)