Hennes & Mauritz paid 247 times the money!

The last buy signal was six months ago, when you could have bought Hennes & Mauritz for SEK 128. The price now stands at around SEK 186, i.e. an increase of around 31%. Good return in half a year, right? Compare with what you got at the bank.

Source: Vikingen.se

The chart comes from the stock exchange program Vikingen. There are reasons why the program is still in use after almost 40 years. The program does its job well. But how does it work? The chart shows that there are red and green bars. When it turns red, it means that there is a greater risk of decline and this is called a sell signal, an indication that it may be a good time to sell.

When the bars turn green, there is a better chance that the price will start going up. We call this a buy signal. But can a computer know whether the price will go up or down? Of course not, but it’s a good guess. If nothing unusual happens, the tip will come true many times. Think of it as the computer giving you tips.

In the chart above, a model called the Price Band gives you tips on whether to sell or buy. There is a mean value in the middle and next to that mean value there are two other lines that follow the mean value. When the price goes outside the band, it becomes a buy or sell signal. In the Viking, there are other band models that are even more advanced that produce fewer transactions, with slightly lower risk and slightly lower profit.

Everyone knows that prices go up or down in small increments. If you put a band around the price, you avoid a lot of unnecessary buying and selling transactions.

Using the course tape model is a good way to filter out unnecessary signals. The larger the band, the fewer signals and vice versa.

Price bands are an excellent model to use on slow-moving items such as shares or funds. A long-term model. In the example above, if you had followed the tip once a month for Hennes & Mauritz (H&M) in Vikingen since 1980, you could have received an incredible 247x the money.

But how can you find the next high-yielding stock? Firstly, it is good to understand which industries are doing well or you think will do well. Then you can look at the economics of a number of companies in that industry.

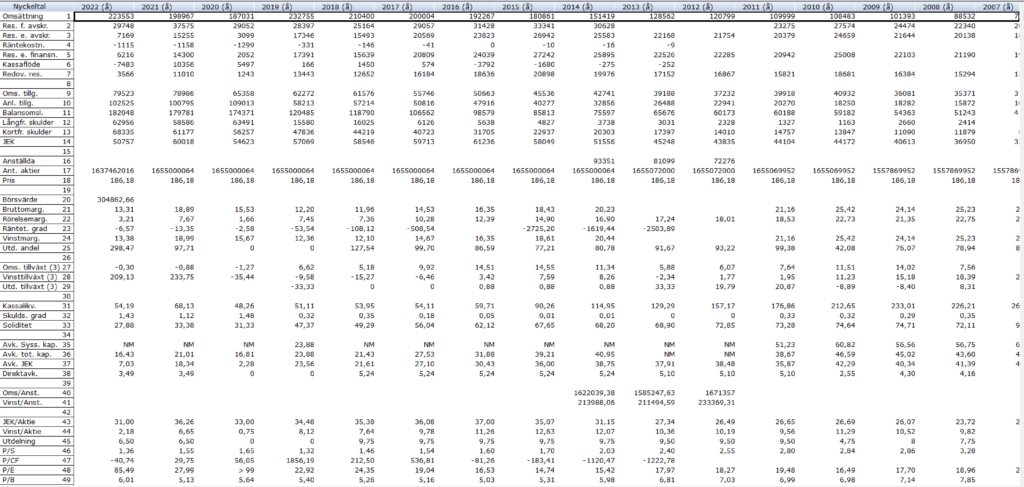

In Viking it is possible to obtain about 50 different key figures. This is what it looks like for H&M:

Source: Vikingen.se

Source: Vikingen.se

Wow, that’s a lot of numbers, but you don’t need to know them all. Vikingen allows you to rank the different companies against each other, one of the few programs that can do this. There are special filters that bring out the best tips every day. You will receive a list of stocks that you can assess using price bands and other models. You can see more than a computer can see, you can see which way it is leaning, you can see the smooth movements in a graph more easily than a digital computer can.

Unfortunately, things happen that are difficult to predict: wars, interest rate increases, etc. Therefore, it is good to supplement with buy and sell signals, so that you sell in time and keep most of your money.

Of course, it’s good to buy a number of shares, ETFs and mutual funds to both increase opportunity and reduce risk. Maybe 15 different securities. “Let the profits run and cut the losses short” is a very good basic rule. Then when you’re ready, you can add more countries and maybe even exchange-traded funds, certificates, mutual funds and more. There is support for this in the Viking.

Tired of missing all the good deals on the stock market?

Vikingen, Sweden’s oldest stock market program, helps you find the winners and sell in time! You can quickly see which stocks are worth buying and which are going down.

Viking’s smart filter gives you daily suggestions on the best stocks of the moment.

Try Vikingen.se at half price!!! Works on PC and MAC. (All MAC-OS works but not the M2 processor, then it can be run with the add-on program Crossover which costs 74 dollars).

Order at Vikingen.se and enter the discount code ‘Sentinel’. Valid for 2 weeks. Take care now.

Half price for Vikingen Börs will be 185 kr per month or 1850 kr for a year. That’s five kronor a day to avoid seeing the stock market go up without you being on the train.

About the Viking

With Viking’s signals, you have a good chance of finding the winners and selling in time. There are many securities. With Viking’s autopilots or tables, you can sort out the most interesting ETFs, stocks, options, warrants, funds, etc.

Click here to see what Vikingen offers: Detailed comparison – Stock market program for those who want to become even richer (vikingen.se)